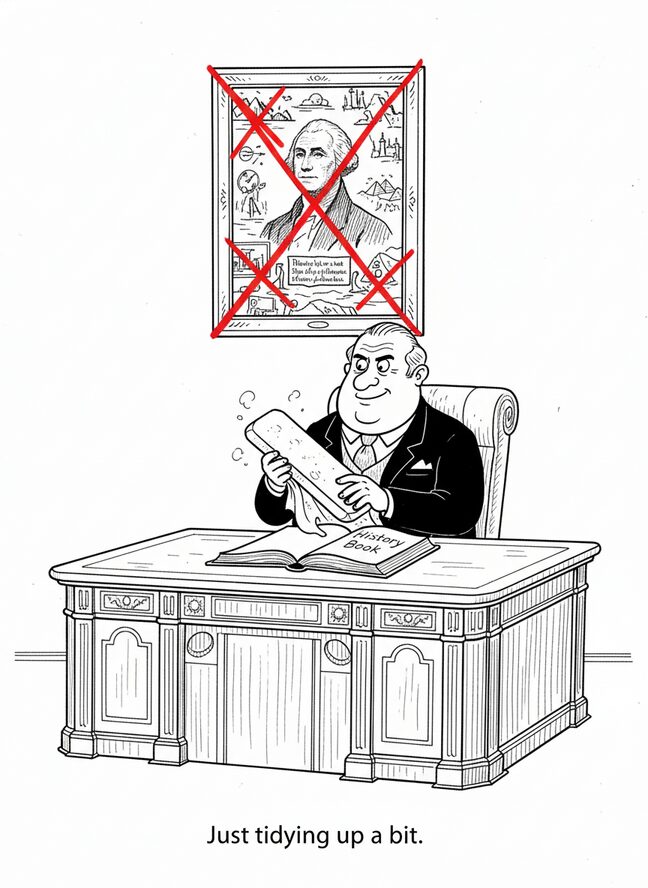

In his latest sweeping executive proclamation, former President Donald Trump announced Friday that he would single-handedly cap all U.S. credit card interest rates at 10% for one year, sparking both excitement among Americans and confusion among people who understand basic civics.

“No more 29% interest! Nobody’s ever seen interest rates so low! It’s going to be beautiful, just like my golf swing,” Trump declared on his social media platform, Truth Trumpet. He did not specify how his administration would bypass Congress, the Constitution, and the general laws of mathematics to enforce the cap, but did suggest that “powerful, incredible” steps would be taken—possibly involving gold leaf pens.

While many consumers cheered the announcement, financial experts were less optimistic. “It’s unclear whether the federal government can actually dictate private lending terms by tweet,” said Christopher Spiggleman, a senior analyst at the Institute for Fiscal Make-Believe. “But if it works, I look forward to him capping the price of avocado toast next.”

Some credit card companies have responded with concern and innovative new fees. “We’re unveiling the ‘Interest Management Surcharge,’ which will allow us to maintain profit margins and also teach consumers about the importance of reading the fine print,” explained Chase Bank spokesperson Donna Refloat.

Trump supporters remained undaunted. “If he can build a wall, he can build an interest wall,” said lifelong Mar-a-Lago waiter Jimbo Riggins. “Next, I hope he caps how often my ex texts me during football.”